when are property taxes due in williamson county illinois

That updated value is then taken times a combined levy from all taxing entities together to calculate tax due. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Establishing property tax rates and carrying out appraisals.

. In most counties property taxes are paid in two installments usually June 1 and September 1. 2018 - 2019 Real Estate Tax Collection Schedule. Counties and Williamson in addition to.

Williamson County collects on average 138 of a propertys. July 12 Sept. The Williamson Central Appraisal District is a separate local agency and is not part of Williamson County Government or the Williamson County Tax Assessors Office.

The Trustee is also. July 11 1st Installment Due. Mail received after the.

A USPS postmark date of 22823 will be accepted as proof of timely payment. According to Williamson County Treasurer Ashley Gott this years due dates are Aug. The median property tax in Williamson County Illinois is 1213 per year for a home worth the median value of 87600.

Along with collections property taxation takes in two additional general functions. 2022 Williamson County property taxes are due by February 28 2023. The treasurers office will begin accepting payments on Monday July 26.

173 of home value. March 7 Sent off final abstract. After September 25th a 10 fee PER PARCEL will be added in addition to the 1 12 per month late fee.

May 3 Co Clerk Extends Taxes. Property tax is calculated by multiplying the propertys assessed value by the total tax rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would. May 28 Mail Tax Bills.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. The median property tax also known as real estate tax in Williamson County is based on a median home value of and a median effective property tax rate of 138. Tax amount varies by county.

Those entities include your city Williamson County districts and special. The County Trustee is responsible for using that tax rate and the tax roll from the Assessors office to create and send out tax bills to all county property owners. You will be assessed a penalty at 1 ½ per month.

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

County Clerk And Recorder Williamson County Illinois

Williamson County Il Land For Sale 24 Vacant Lots

Williamson County Homeowners 65 Plus And Disabled To See Property Tax Relief Community Impact

Illinois Property Tax Calculator Smartasset

Williamson County Il Luxury Homes For Sale 296 Homes Zillow

59 Acres Williamson County Il Farmland Farm Tillable Barn Timber 2400l Buy A Farm Land And Auction Company

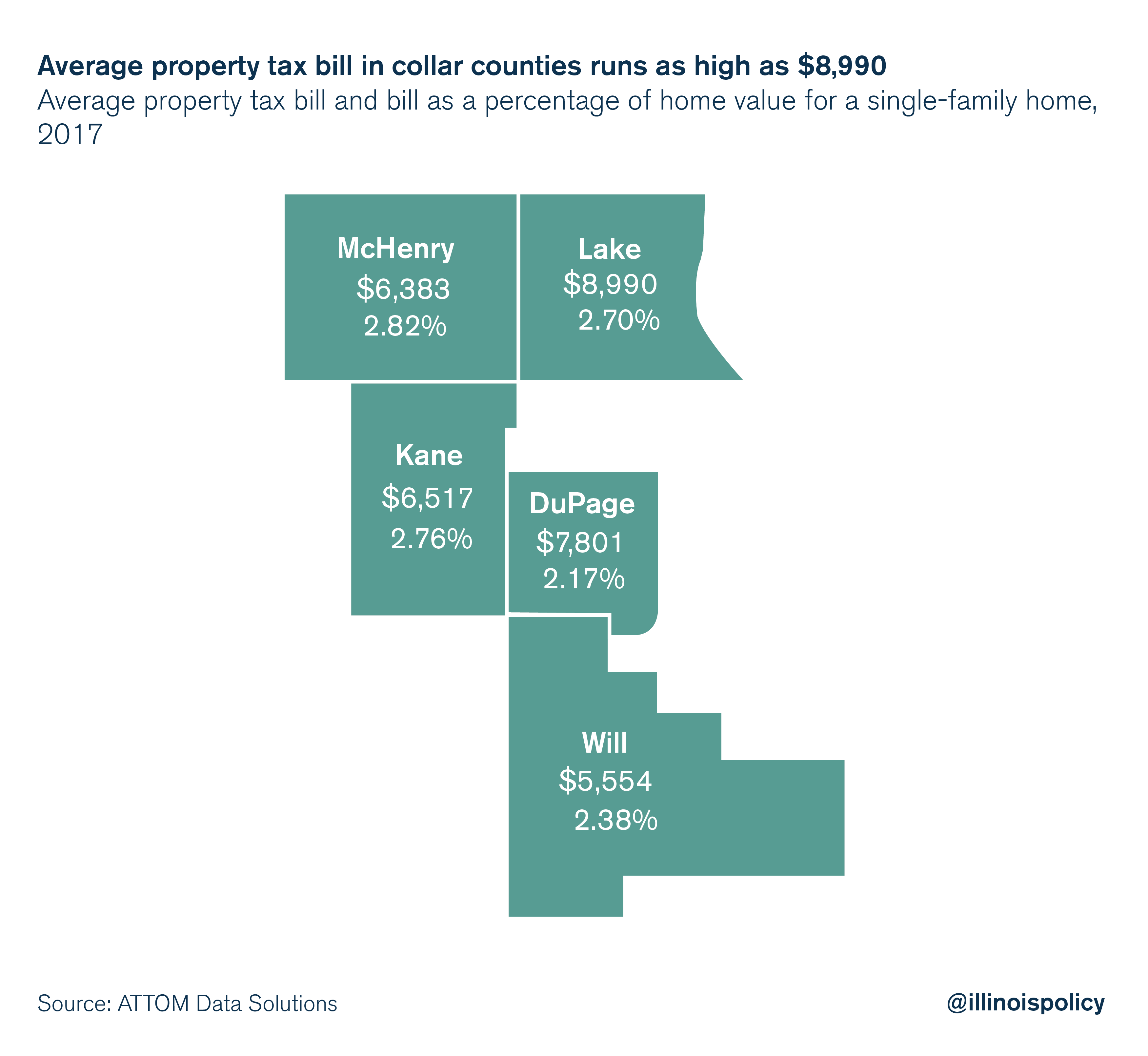

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

Williamson County Il Real Estate Williamson County Il Homes For Sale Zillow

Cheap Houses For Sale In Williamson County Il Point2

Circuit Clerk Williamson County Illinois

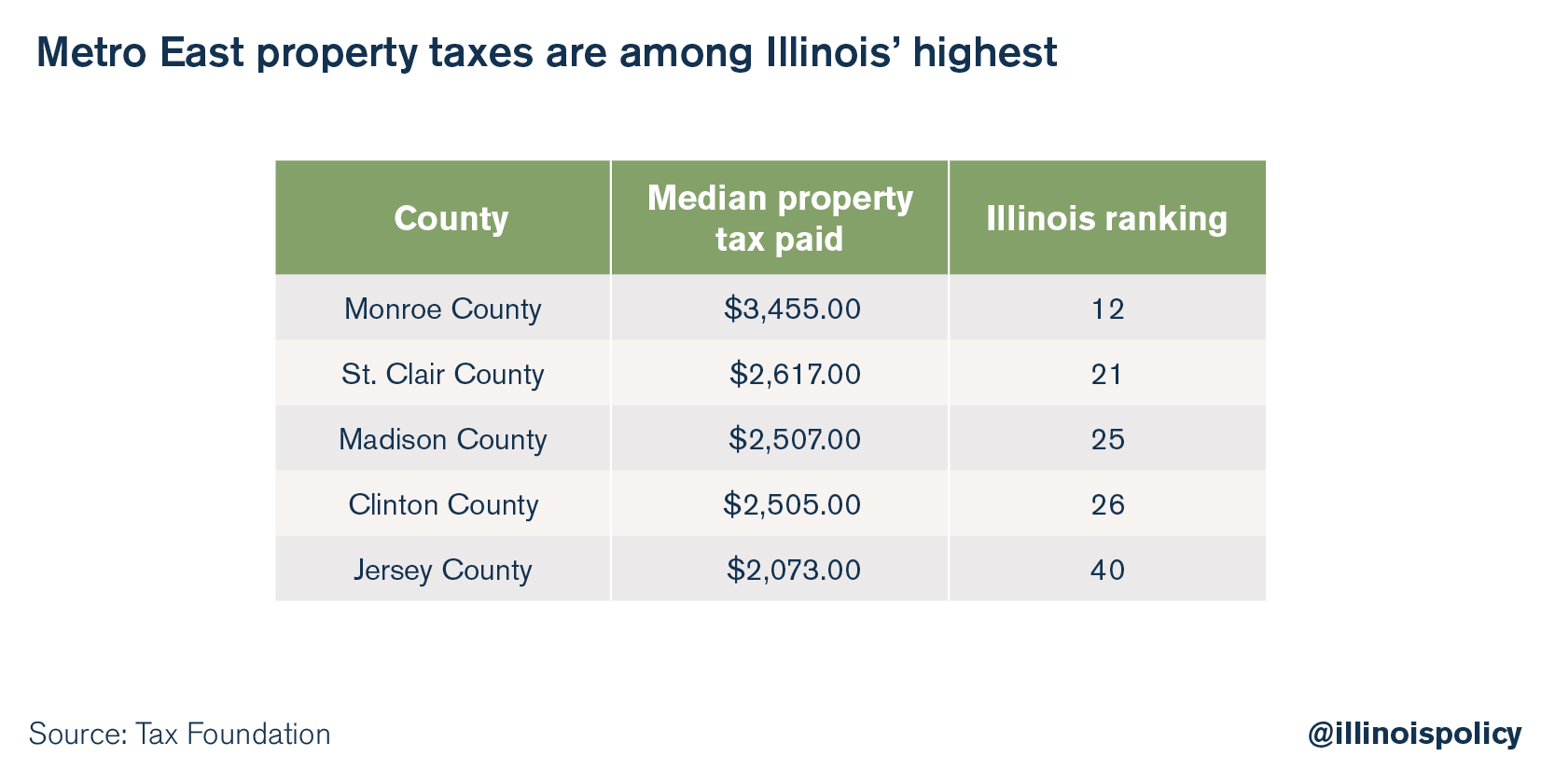

Metro East Median Property Taxes Rank In The Top 50 Highest In Illinois

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Property Tax Bills Hit Kane County Mailboxes

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More